There are two types of mental actions that we primarily use when making decisions about most anything we do or buy. In general they are one of the two following ways: Either we use emotions and sentiments (E&S’s) or knowledge and understanding (K&U). Which one do you think the advertisers rely on almost exclusively when seeking to get you to make a buying decision for a particular product?

Just think of the advertising for soft drinks. “Pepsi hits the spot” and “the Pepsi generation” are old slogans you likely recognize. The TV ads showed attractive young adults playing volleyball at the beach. The association with the good times, youth, and vitality was very powerful. Never mind the fact that the consumption of soft drinks, especially colas, can lead to all sorts of adverse health effects. For more details about the latter, please refer to my archived Newsletter #9 and Newsletter #13.

There’s little controversy left concerning the fact that smoking is a really bad thing for one’s health. That should be obvious, as sucking smoke containing dozens of carcinogens into one’s lungs year after year inevitably leads to all sorts of health problems. However, despite what would appear to be common sense, the macho Marlboro man and the feminist Virginia Slims woman sold billions of dollars’ worth of cigarettes.

In light of the fact that buying and drinking soft drinks is literally peeing one’s money down the drain and smoking is literally burning up one’s cash, how do advertisers convince people to make these purchases? It’s real simple; they appeal to one’s emotions and sentiments. In spite of all the logical reasons for declining such purchases, people continue buy them anyway. The truth is, emotions and sentiments are a far more powerful motivator than knowledge and understanding. This is so much the case that people’s E&S’s often override any common sense whatsoever. The ad designers, schooled in the art of advertising psychology, are well aware of this and are experts at manipulating people’s emotions in order to get them to think and act a certain way.

Just walk down the grocery store aisle containing laundry detergents. There are enough exotic designs and swirls to dazzle anyone’s imagination. A plain white box that says, “Tide Laundry Detergent” in black, block letters does not have the sensory stimulation as does Proctor & Gamble’s real thing. This sensory stimulation is part of the appeal to one’s emotions and sentiments. The product designers know this, and where appropriate, they take full advantage of this technique.

The case is just as true when it comes to the promotion of Medigap insurance or Medicare supplements. However, a different set of emotions and sentiments is targeted. Obviously, the advertisers are not pushing the Pepsi generation or the Marlboro man, so what E&S’s do you think they hit on?

Let’s see, seniors want to have the confidence that their Medicare supplement company is solid, trustworthy, and will pay its claims. One national organization uses this approach in their TV ads for their Medicare supplements. Speaking somewhat melodramatically, their voice-over commentator makes this emotional appeal to you the viewer: “You have your Medicare health insurance card and our I.D. card; you are now set!” From the standpoint of an appeal to a person’s E&S’s, these ads are powerful and extraordinarily well done. You’ll notice in this example there is no mention at all of being competitive or getting the best buy.

In print advertising, including mailers, some insurance companies make an implicit claim that their product is somehow superior to others. They extol their benefits as if somehow, their plan is uniquely better. Their graphics, color schemes, and advertising copy are carefully orchestrated to give you the reader, the impression that these are the people you can trust.

|

|

| Click to enlarge | Click to enlarge |

During the appointment the agent doesn’t mention the card at all. But if you do inquire about the “under $50” product, he says, “Well really, that’s (meaning the high-deductible Plan F) not that popular of a plan. Most people want more benefits and get Plan F.” If you haven’t guessed it already, this technique is called bait and switch.Some mailers definitely push the envelope on ethics. Here’s a piece I picked up from a home a couple years ago. Hmm, a Medicare supplement for less than $50? The promoter of this oversized postcard wanted to appeal to a person’s sense of “getting a good deal”. Don’t we all love bargains! This company ostensibly promoted their high-deductible Plan F, which statistically, zero percent of the Medicare supplement shoppers buy. So yes, the real objective of this card was to get people to ring their 800 number and to get their agent in front of people.

I should add that whenever a mailer mentions a Medicare supplement rate, most all states’ insurance departments require the company to specifically state the exact rate and which plan that rate references. There can be no ambiguity allowed whatsoever, as there must be full disclosure. The state where this first card originated is an exception to the general rule.

|

|

| Click to enlarge | Click to enlarge |

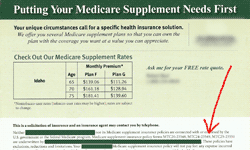

This second specimen is an example of a full-disclosure postcard. You’ll notice that the plan letters and rates are clearly displayed. The fine print at the bottom of the card discloses the legal form numbers for each plan mentioned (red arrow). As it states just the facts, this card is straightforward in its use of K&U. There is no appeal to one’s E&S’s. It exemplifies a fully compliant advertising piece. The agent that mailed this card is simply saying, “Here is a company I represent, here’s their rate, and here’s my contact number.”

As an aside, there is something else very instructive to learn here. Notice that the difference at age 65 between their Plan F rate, $139 per month, and their Plan G rate, $111 per month, is $28 per month. $28 times 12 months equals an annual $336 more to buy their Plan F. All you are getting for $336 is a $147 (in 2015) Part B deductible benefit. Do your E&S’s tell you that you have to get Plan F, or does your knowledge and understanding suggest that Plan G, in this situation, is a better buy?

In another mailer the advertiser makes an interesting assertion: “Helping you with the High Costs of Medical Care”. Their appeal to your E&S’s is to get you to think that they are on your side. The brochure is well done as far as the copy and printing goes. The only problem with this piece, however, is they are making things worse because they attempt to sell you their high priced Medicare supplement. I wrote about this company in my document, Ten Dishonest Tricks of Unethical Agents.

How do they entice people to pay for their non-competitive Medicare supplement products? Simple. They train their agents to push people’s emotional buttons. They’re experts at pandering and manipulating. Unfortunately, there are enough gullible people who fall for their hype, as this company is still around. Once you expose their agents for who they are and what they do, they run like scared cockroaches.

To assist people in combatting this promotional nonsense, I wrote the Ten Medicare Supplement Shopping Mistakes. To listen to this fifteen minute audio presentation, please click here. In Mistake #1 we learn that the plans are standardized. Therefore, any company’s Plan F will have identical Medicare benefits to any other Plan F. So, if Brand X claims the virtues of their plans, you can substitute Brand Y or Z, instead. You can rest assured that the benefits are identical. The only exception is that a couple of companies may offer a dental & vision or a health club benefit, but at a higher premium.

Not only do companies push people’s emotions and sentiments button, but people do it to themselves. How many times have I heard people say, “Do they pay?” Initially, that’s a good question, especially if a person has heard about the war stories of some under-65 health insurance company not paying their fair share of their claims.

That’s why I wrote Mistake #2, which is thinking that a company will not pay its claims. They all pay their claims, even the ones that use questionable marketing ethics. They are mandated by the state insurance departments to do so. Even after I have put this information in people’s hands, some have still persisted with their doubts and fears (E&S’s) about a particular company not paying its claims. If still in doubt, they can contact the consumer affairs office at their state insurance department regarding the complaint history of any company. There may be an infrequent billing error, but rest assured; the companies, all of them, pay their claims!

All of my Ten Mistakes are based on knowledge and understanding. This is to assist you, the shopper, to make the best buy for your situation. A good working knowledge of these Ten Mistakes will help steer you to the use of your K&U faculties rather than relying on E&S’s. Unfortunately, there are those people, even when the facts are dropped in their laps, who still persist in spending sometimes hundreds of dollars more per year than they need to.

Why does this occur? I think it’s mainly due to the fact that some people let their emotions and sentiments drive most of their decisions. These tend to be the people who are willing to spend a dollar on gas driving across town to save a dime on a bag of sugar! It is also my observation that these are the types of people who are buffaloed by the slick-talking agent that is fully aware of this situation and uses emotions and sentiments to pander to them.

Much more could be said about this aspect of human psychology, but that is beyond the scope of this article.

Take a Quiz

To assist you in determining your shopping type, I have developed the following quiz. The following are statements that I have heard people say over and over. Mark “A” if you believe the statement is based on emotions and sentiments, and mark “B” if you believe the statement to be based on knowledge and understanding.